How to Calculate Year-Over-Year YOY Growth

What Is Year-Over-Year (YOY)?

Year-over-year (YOY)—sometimes cited as year-on-year—is a ofttimes used money comparison for staring at 2 or additional measurable events on Associate in Nursing annualized basis. perceptive YOY performance permits for gauging if a company’s financial performance is improving, static, or worsening. For example, you will scan in financial reports that a specific business reportable its revenues accrued for the third quarter, on a YOY basis, for the last 3 years.

What Is Year-Over-Year Growth?

YOY Growth is one of the most important concepts that you should have a good grasp on if you’re interested in starting a business. Whether you’re looking for an idea for a product or want to start an investment fund, you’ll need to have a firm grasp of how this concept works.

What Is the Calculating Year-Over-Year

YOY growth is a type of financial metric that is used to measure business performance. It can be used in a variety of ways to help with your business’s decision making and long-term success. In addition to providing a comprehensive picture of your business’s performance, YOY growth can also be used to determine how successful your business expansion has been.

Using year-over-year growth can help you identify areas in which your business needs improvement. For example, a low YOY growth percentage may mean that your production efficiency is not up to par. It may also indicate that you are having manufacturing problems or are running into overhead and expansion costs. You can use this information to plan for the future and make the necessary changes.

Using a year-over-year calculation is one of the easiest methods to calculate financial figures. All you need to do is calculate the difference between your yearly earnings and your annual earnings from the previous year. Once you have the number, multiply it by 100 and you will have the answer. The next step is to convert it into a percentage. For instance, if your yearly earnings were $1.5 million in the first six months of 2017, your year-over-year growth is 50 percent.

A year-over-year calculation can provide a quick and accurate financial report. However, it is important to remember that this is only a portion of the total picture. You should also compare it with other metrics to get a more complete view of your business’s performance.

Year-over-year growth is one of the most common types of business finance figures. This metric is used in a variety of industries to track the performance of businesses. It can be used to show investors whether a company is a good investment. It can also be a good indicator for lenders when applying for a loan.

To calculate year-over-year growth, start by figuring out what area of your business you would like to measure. This can be done by using a spreadsheet app or a business data software. In most cases, businesses use spreadsheet apps, such as Google Sheets or Microsoft Excel.

What Are the Advantages of Year-Over-Year Growth?

Using year-over-year growth (YOY) figures to analyze your company’s performance is a great way to track trends. Knowing how your business is growing can help you make better strategic decisions. For example, if your company is experiencing slower growth, you may need to make adjustments to your business strategies.

One of the best ways to use year-over-year growth calculations is to benchmark against your competitors. If your competition is outpacing your growth rate, focus on a specific area of your business that’s performing well. Aside from helping you to compare your revenue to your competitors, year-over-year data is also a helpful way to identify areas of opportunity for your business.

If your business is experiencing slower growth, you might need to adjust your marketing strategies or hire more employees to meet demand. You might also want to consider introducing a new lead generation process to improve your company’s growth rate. YOY growth calculations can also help you to identify seasonal trends. The holidays are a popular time for eCommerce stores to experience significant spikes in sales.

YOY calculations can also reveal inefficiencies in your spending habits. If you’ve been noticing that your prices are a little higher than your competitors, you might want to take a closer look at your pricing strategy. Using YOY numbers to evaluate your profitability allows you to see how much you’re earning per dollar spent, and it helps you to make better financial decisions.

YOY metrics are also a great way to motivate your employees. If your company has been experiencing increased expenses, you might be able to use a positive YOY number to show that you’re investing in assets and personnel. This can help inspire your team to grow the next year.

YOY is a simple calculation that can be used to compare nearly any figure. It can also be used to calculate performance over a month, a quarter, or a whole year. It’s also important to remember that the number can be negative, which indicates that your business is losing money. YOY isn’t always the most accurate metric to measure growth, but it can be a useful tool.

What Are the Disadvantages of Year-Over-Year Growt

Using year over year growth calculations is often used in financial analysis, economics, and data analytics. These formulas help businesses track trends and performance, as well as predict future success. It is also one of the most common metrics in business dashboards. However, there are disadvantages to using YOY growth.

First, YOY measures remove seasonality, which is a factor that can affect short-term results and can be difficult to analyze. Secondly, YOY metrics are not ideal for startups. Those with less than 13 months of operations do not have a previous year to compare their numbers with. This means that yearly measurements may overlook bad months or miss opportunities to improve.

In contrast, sequential growth allows investors to see a more linear growth rate. In other words, comparing one quarter to the next can make statistics appear more reliable. In addition, a company that has a strong sales month in one year, followed by a weak sales month in the next, can indicate problems that can turn into a negative trend if the company is not able to rectify the situation.

Lastly, YOY is sometimes used by investors, who can sometimes put a high value on it. This is because a company’s growth over a year is the clearest measure of its performance. While this may be helpful to investors, it is important to remember that it does not provide an explanation of why a company is doing well. It is therefore best to use year over year growth in conjunction with other key performance indicators.

The advantages of YOY growth include the fact that it provides a better picture of seasonality than monthly metrics. It is also more accurate in predicting long-term outcomes. Another benefit of YOY growth is that it can be easily calculated. It is a simple process that involves subtracting the current year’s number from the previous year’s number to get the year’s difference. Depending on the amount of data, rounding can be done to near a whole number, or it can be worked in decimals.

It is also easy to interpret. Unlike other metrics, YOY provides a clear, percentage figure for the growth of a company. The number can be negative or positive, indicating whether the growth is increasing or decreasing. This is helpful in identifying areas that need improvement.

Want to Learn More About Business?

Whether you’re planning to attend a business school or just want to learn more about the business world, there are several ways to get started. Read up on what you want to learn, and then apply for jobs that allow you to gain real-world experience. These positions will give you valuable experience as well as the knowledge you need to be successful in your future career.

Whether you’re an entrepreneur or you’re working for a company, you can find the information you need by reading the business news and taking advantage of online resources. Especially if you’re interested in entrepreneurship, you should check out the Harvard Business Review, which is one of the best sources for business news. It offers articles on a wide range of topics, from entrepreneurship and strategy to technology and innovation.

KEY TAKEAWAYS

• Year-over-year (YOY) could be a methodology of evaluating two or more measured events to match the results at one amount with those of a comparable amount on Associate in Nursing annualized basis.

• YOY comparisons are a preferred and effective thanks to measure the money performance of a corporation.

• Investors seeking to measure a company’s financial performance use YOY reporting.

Also Read: WHAT IS DIGITAL SELLING MARKETING (DIGITAL MARKETING)?

Understanding YOY

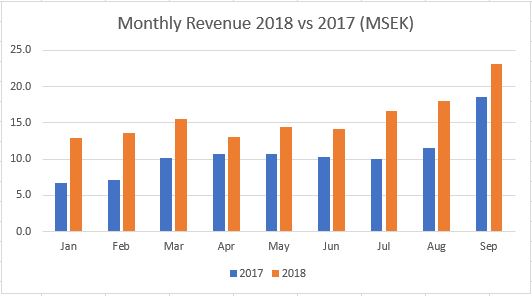

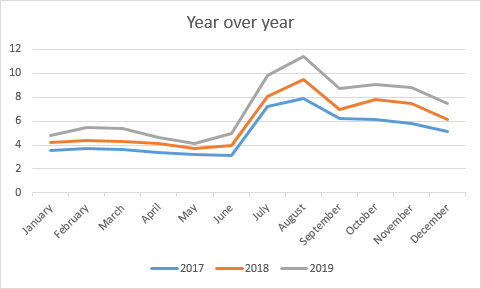

YOY comparisons are a popular and effective way to evaluate the financial performance of a company and also the performance of investments. Any measurable event that repeats annually may be compared on a YOY basis. Common YOY comparisons embrace annual, quarterly, and monthly performance.

advantages of YOY

YOY measurements facilitate the cross comparison of sets of data. For a company’s first-quarter revenue mistreatment YOY knowledge, a {financial Associate in Nursingalyst|securities analyst|analyst} or an capitalist will compare years of first-quarter revenue data and quickly ascertain whether or not a company’s revenue is increasing or decreasing.

For example, within the half-moon of 2021, the Coca-Cola corporation reportable a 5% increase in web revenues over the primary quarter of the previous year. By examination constant months in numerous years, it’s potential to draw correct comparisons despite the seasonal nature of client behavior.3 This YOY comparison is additionally valuable for investment portfolios. Investors wish to examine YOY performance to ascertain however performance changes across time.

Reasoning Behind YOY

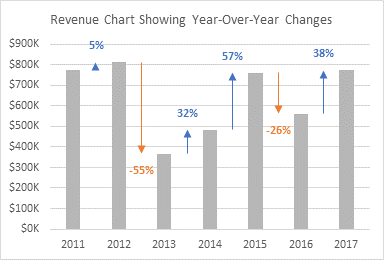

YOY comparisons are common once analyzing a company’s performance as a result of they assist mitigate seasonality, an element that may influence most businesses. Sales, profits, and different money metrics amendment throughout different periods of the year because most lines of business have a season and an occasional demand season.

For example, retailers have a peak demand season during the vacation looking season, that falls within the fourth quarter of the year. To properly quantify a company’s performance, it is smart to match revenue and profits YOY.

It’s vital to compare the fourth-quarter performance in one year to the fourth-quarter performance in different years. If Associate in Nursing capitalist appearance at a retailer’s leads to the fourth quarter versus the previous third quarter, it would seem that a corporation is undergoing new growth once it’s seasonality that’s influencing the distinction within the results. Similarly, during a comparison of the fourth quarter with the subsequent 1st quarter, there might appear a dramatic decline, when this might even be a results of seasonality.

YOY conjointly differs from the term sequential, that measures one quarter or month to the previous one and permits investors to see linear growth. For instance, the amount of cell phones a technical school company oversubscribed within the fourth quarter compared with the third quarter or the number of seats Associate in Nursing airline crammed in January compared with December.

Real-World Example

during a 2019 NASDAQ report, Kellogg Company discharged mixed results for the fourth quarter of 2018, revealing that its YOY earnings continued to decline, even once sales accrued following company acquisitions. Kellogg foretold that adjusted earnings would call an extra 5% to 7% in 2019 because it continued to take a position in alternate channels and pack formats.4

The company conjointly discovered plans to reorganize its North America Associate in Nursingd Asia-Pacific segments, removing many divisions from the previous and reorganizing the latter into Kellogg Asia, Middle East, and Africa. Despite decreasing YOY earnings, the company’s solid presence and responsiveness to client consumption trends meant that Kellogg’s overall outlook remained favorable.4

what’s YOY Used For?

YOY is employed to create comparisons between only once amount and another that’s one year earlier. this enables for an annualized comparison, say between third-quarter earnings this year vs. third-quarter earnings the year before. it’s normally wont to compare a company’s growth in profits or revenue, and it may be wont to describe yearly amendments in an economy’s cash supply, gross domestic product (GDP), and different economic measurements.

however Is YOY Calculated?

YOY calculations are easy and typically expressed in proportion terms. this may involve taking this year’s price and dividing it by the previous year’s value and subtracting one: (this year) ÷ (last year) – 1.

What’s the distinction Between YOY and YTD?

YOY appearance at a 12-month change. Year thus far (YTD) looks at a change relative to the start of the year (usually Jan. 1).

What If i’m curious about Comparisons for fewer Than a Year?

you’ll be {able to} figure month-over-month or quarter-over-quarter (Q/Q) in a lot of constant manner as YOY. Indeed, you can select any timeframe you desire.

the basics of finance and Accounting

no matter your learning style, understanding corporate finance and accounting is simple once you can select from 183,000 on-line video courses. With Udemy, you’ll be able to learn accounting word and the way to organize money statements and analyze business transactions. What’s more, every course has new additions printed each month and comes with a 30-day money-back guarantee.

Post a Comment

You must be logged in to post a comment.